|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

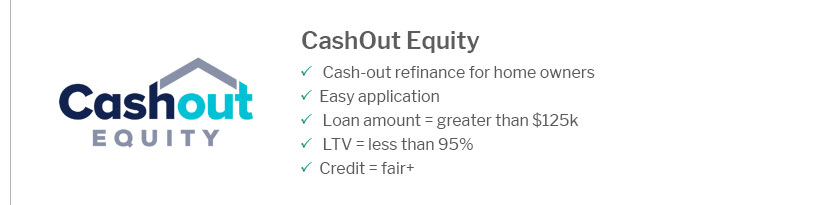

Best Refinance Companies for Home Loans: A Comprehensive GuideRefinancing your home loan can be a smart financial move, offering potential savings, lower interest rates, and better loan terms. However, selecting the right refinance company is crucial. This guide explores top refinance companies and provides insights to help you make an informed decision. Understanding Refinance OptionsWhen considering refinancing, it's important to understand the different options available. Each option comes with its own benefits and considerations. Rate and Term RefinanceThis is the most common type of refinancing, allowing you to change the interest rate, loan term, or both. Cash-Out RefinanceWith a cash-out refinance, you can borrow more than your existing loan balance and receive the difference in cash, which can be used for home improvements or other expenses. Streamline RefinanceDesigned for those with existing government-backed loans, a streamline refinance in Utah offers a simplified process with fewer documentation requirements. Top Refinance CompaniesHere are some of the leading companies renowned for their refinance services.

Factors to Consider When Choosing a Refinance CompanyChoosing the right refinance company involves evaluating several factors to ensure you get the best deal. Interest RatesLook for competitive interest rates that can save you money over the life of your loan. Customer ServiceStrong customer service is vital, as refinancing can be a complex process requiring expert guidance. Fees and Closing CostsBe aware of any fees or closing costs associated with refinancing, as these can impact your overall savings. Frequently Asked Questions

https://money.usnews.com/loans/mortgages/mortgage-refinance-lenders

Best Mortgage Refinance Lenders of January 2025 - Best Mortgage Lenders for Refinancing - Lenders in More Detail - Rocket Mortgage - PenFed Credit Union - New ... https://www.lendingtree.com/home/refinance/

Our picks for the best refinance lenders of 2025 - Best refinance lender overall: Rate - Best online mortgage refinance experience from a traditional bank: Chase. https://www.businessinsider.com/personal-finance/mortgages/best-mortgage-refinance-lenders

Rocket Mortgage Refinance by Quicken Loans: Best overall - Third Federal Savings and Loan Mortgage: Best for low costs - Pentagon Federal Credit ...

|

|---|